TAKE OFF CHALLENGE

Jumpstart Your Financial Planning

with Your Wealth Check-up

#30DayChallenge

Welcome to TakeOffChallenge.com!

We will begin with our first step, Your Wealth Check-up!

*The following illustrations work with Your Wealth Check-up brochure.

WEALTH BUILDING

HOW YOUR MONEY GETS TAXED

Do you own any of the following?

- Tax Now

- Tax Deferred

- Tax Advantage

Whenever you have income, short term capital gain, or long term capital gain, your gain/profit is subject to taxation when your gain is realized.

Examples include your wage, interest income from saving accounts or CDs, dividend income from stocks, or capital gain from selling assets such as stocks/bonds.

Tax-deferred investments are typically something like an retirement account, which you don’t pay tax until you withdraw from the account at a later time. You contribute to the account with money that has not yet been taxed.

These accounts are funded by pre-tax money, which is also known as tax-deferred.

Examples for tax-deferred accounts include pensions, 401(k)/403(b), annuity & IRAs.

The term “tax-advantaged” refers to any type of investment & financial accounts that are either exempt from taxation, tax-deferred, or offers tax benefits if certain conditions are met.

These accounts are usually funded by after-tax dollars.

Examples include ROTH IRA, ROTH 401(k), municipal bond, 529 College Savings Plan, and cash value life insurance.

EMERGENCY FUND

What is an Emergency Fund?

An emergency fund is money that is set aside for unplanned expenses, such as medical bills, car repairs, home repairs, or loss of income due to losing job or disabilities.

Do you know how much you should set aside for your emergency fund?

Answer

The right amount depends on your financial circumstances. Typically, you should have enough to cover at least 6-12 months worth of living expenses.

If your monthly expense is $3,000, your emergency fund should be between $18,000 and $36,000. This is the money you keep in an account such as a high yield savings account with easy access.

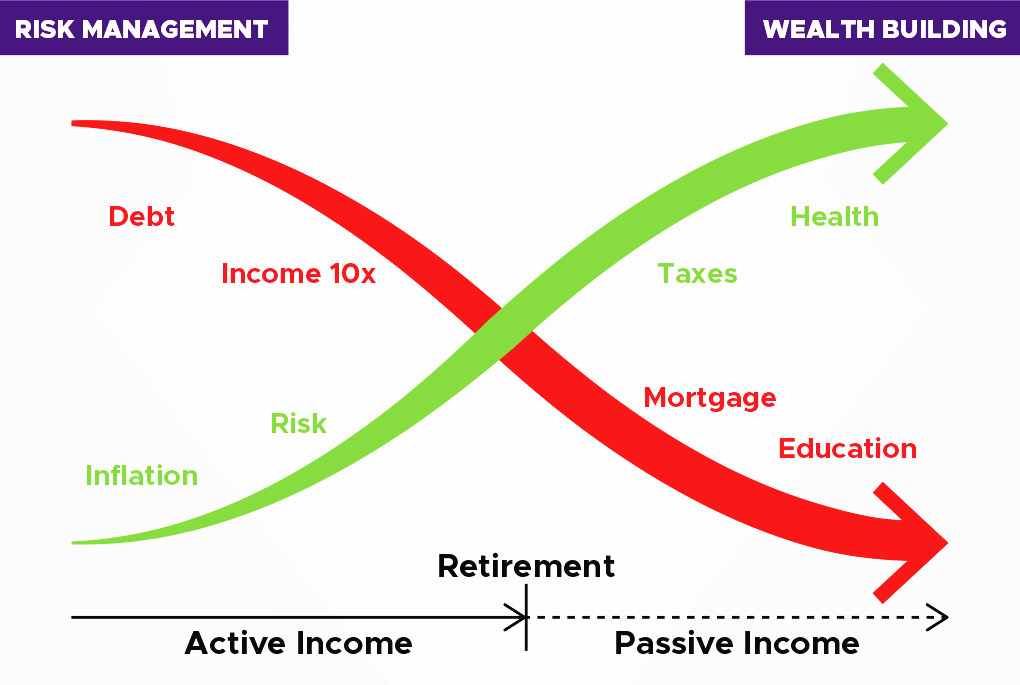

X CURVE CONCEPT

The X Curve concept shows the relationship between the wealth curve (green) and the responsibility curve (red) on a timeline. Where on the left side of the timeline, people usually have more responsibilities (risk) and less wealth, as time goes on, responsibilities (risk) decreases and wealth increases, ideally.

PRIORITY LIST

- ESTATE PLANNING

- LIFE INSURANCE

- LIVING BENEFITS

- EMERGENCY FUND

- DEBT MANAGEMENT

- TAXES

- INCOME

- WEALTH

GOAL

Your goal is to figure out your priority order for the list on the left, and to figure out what your goals are for each item.

As you tackle each item, you will be able to start decreasing your responsibilities and risks, represented by the red curve in the X Curve diagram, and start building your wealth, which is represented by the green curve.

Build your passive income streams while you continue to work on your active income.

RISK MANAGEMENT

LIFE INSURANCE

"Income for family and protection of your assets"

- Why Life Insurance?

- What are the Benefits

- How to Buy

Life insurance is one of the most important parts of financial planning.

It protects your family and provides them a non-taxable lump sum when you are no longer with them.

In the U.S, there are 60 million families who have no or limited life insurance. This would cause severe financial hardship if the income earner of the family passed away unexpectedly.

The main benefit of any type of life insurance is the non-taxable lump sum upon death of the insured.

This lump sum can be used for income replacement of the deceased, paying off home mortgage or other debt, and provide funds for kids’ college education.

Other benefits for certain types of life insurance include living benefits such as critical illness or long-term care, or a cash value component which allows additional money to grow within the policy based on certain strategies available from insurance providers.

The best way when it comes to purchasing a life insurance policy, is to sit down with a financial professional, who can assess your current life & financial situations in order to provide you the right type of policy for your needs.

The challenges people are facing today for life insurance, include misconceptions on what life insurance provides, its access, and how to calculate the coverage that you need for your life insurance policy.

LIVING BENEFITS

"Replacement of income due to illness or injury, includes disability, long term care (LTC), critical/chronic/terminal illness"

- Disability

- Long-Term Care

- Critical/Chronic/Terminal Illness

A disability insurance can provide you a percentage of your income if you cannot work due to sickness or injuries. Typically you may either get it through your employer, or you can buy your own policy.

There are 2 types of disability policies:

Short-term disability policies may cover your income needs up to two years. Most last for a few months to a year.

Long-term disability may pay benefits for a few years or until the disability ends.

A long-term care insurance policy can help cover the cost of care due to chronic medical conditions, a disability, or a disorder.

A long-term care policy can be purchased as a stand alone policy, or as a rider within a life insurance policy.

Nearly 70% of 65-year-old seniors will need long-term care services according to U.S. Department of Health and Human Services.

Most health insurance do not cover long-term care. Some may cover short term nursing home stays, but usually within first 90 days only.

If you do not have an insurance to cover long-term care needs, you may have to pay for it out of pocket and may deplete your savings in a chronic situation.

Living benefits for critical illness, chronic illness, or terminal illness, can be purchased either as a stand alone policy, or as a rider of existing life insurance policy.

Critical illness benefit within a life insurance policy allows you to access your death benefit if you have heart attack, kidney failure, paralysis, stroke, and other type of critical illnesses.

Chronic illness benefit within a life insurance policy can pay for your care, if you cannot perform at least two of six “activities of daily living”.

Terminal illness benefit within a life insurance policy, allows the insured to access death benefit if he/she is diagnosed with a terminal illness. Also known as “accelerated death benefit” rider, meaning the person has the financial freedom to use the money to put affairs in order, travel, or pay for end-of-life care.

WEALTH

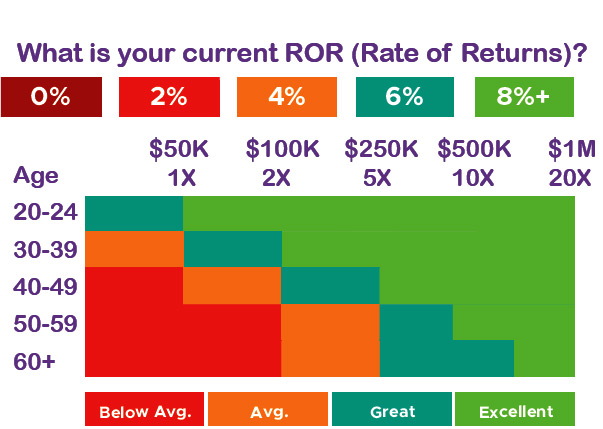

Example: If your retirement projected income is $50K per year, what are you doing today in order to achieve that goal?

A good rate of returns for your investment should be above 6-8%.

Based on the $50K/year as retirement income example, the chart shows the amount of wealth accumulation versus age groups.

For example, if you are 60 and have accumulated 20 times the amount of projected retirement annual income, it is considered "excellent". If you are 49 and have less than $50K in savings, it is considered "below average"

LIFETIME INCOME PROJECTION

It is important to establish income goal for retirement in order to achieve the dollar amount that you will need before you reach your retirement age.

What is your income goal for retirement?

How much do you think you will get from Social Security?

Do you currently have pension?

What is your projected amount for your personal investment?

If your total for social security income + pension + personal investment, is less than your income goal for retirement, what is the amount needed in order to close income gap each month?

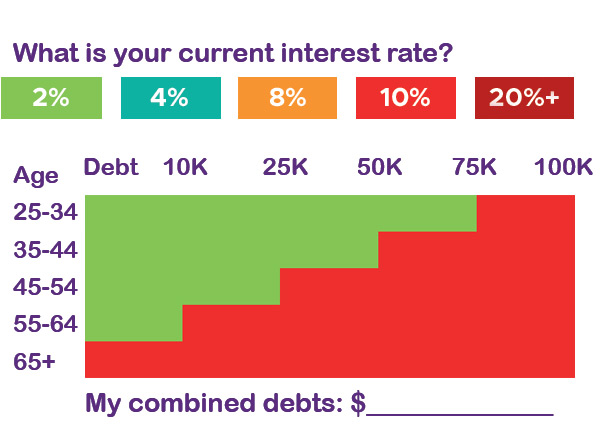

DEBT MANAGEMENT

Controlling your debt can help your "financial ship" from sinking. Interest rate being charged on your debt can eat up your wealth and they must be paid off as early as possible.

Compounding interest can either be your best friend, or your worst enemy. High interest rate on your loans can make you pay way more than what you originally owed.

Having too much debt not only can drain your overall wealth, it can also impact your credit score.

If you must take out a loan for something, always try to find the lowest interest rate possible and pay off the debt as soon as you can.

ESTATE PLANNING

This is one of the most important steps in your financial planning. No one knows when their time is up, and this is something you should plan for while you are able to.

-

Living Will & Last Will

Living will, also known as advanced directive, in an event where you become incapacitated, a living will can help you execute your wishes so your loved ones do not have to make difficult decisions.

A will (last will) distribute any property you own in the event of your death. -

Living Trust

A legal document created during an individual's lifetime for managing his or her assets. There are many benefits for having a trust, such as avoiding probate process and may reduce estate taxes.

-

Power of Attorney

This allows you to select a person you trust to make critical decisions for you on your behalf in the event you become incapable to make those on your own. This includes both legal or financial matters.

-

Healthcare Directive

Also known as Advance Care Planning. If you are having a medical crisis and you are unable to speak for yourself, your family may need to make tough decisions for you and those decisions might be against your wish.

An advance healthcare directive states what your healthcare preference is and goes into effect when you are incapacitated and unable to speak for yourself.

Next step, 30 Day Calendar, #30DayChallenge!

30 Day Calendar

Learn How To Take Control Of Your Financial Future In 30 Days

Day 1: Set Your Goals

Identify short term and long term goals.

Day 2: Assess Your Financial Situation

Know how much you make and how much you spend.

Complete a Financial Needs Analysis with a financial professional to plan your wealth strategy in the right steps.

Day 3: Create a Monthly Budget

Create an estimate of income and expenditure.

Day 4: Prioritize Your Spending

Take care of the essentials first

Day 5: Calculate Your Savings

Calculate how much you can save after spending.

Day 6: Develop an Emergency Fund

Money that can help you and your family go on for at least 6-12 months if your income stops.

Day 7: Tackle Your Credit

A good credit score can help you in the long run.. It can reduce your borrowing cost such as lower loan rates.

Day 8: Track Your Money

Review your expenses, spending and savings

Day 9: Discover Your Net Worth

How much you actually own vs. how much you owe. What are your assets and what are your liabilities.

Day 10: Fund Your Retirement

Grow your money now so you can use it toward retirement later. Time is your best friend when it comes to growing your nest eggs.

Day 11: Review Your Savings

Are you getting the most out of all the investment vehicles you have for your savings?

Day 12: Practice Rule of 72

Rule of 72 tells you how long it takes to double your money for a specific rate of return.

Day 13: Understand Compounding Interest

How does your money grow? With a good rate of return and a good amount of time, your money can grow as time goes on.

Day 14: Learn the Wealth Formula

A formula that helps you calculate your wealth.

Money + Time +/- Rate of Return – Inflation – Taxes = Wealth

Day 15: Rest! Celebrate Your Progress

Take a break.

Day 16: No Spend Day

Challenge yourself to not spend money on “wants”

Day 17: Minimize Tax Consequences

Learn ways to minimize your taxes.

Day 18: Review / Update Life Insurance

Do you have life insurance? Are you properly protected? Understand and review your policy is important and beneficial.

Day 19: Disability, LTC & Living Benefits

Learn the tools that can help you in the events if you become disabled or sick due to accidents or illnesses.

Day 20: Reduce Your Debt

Do you have debt? Getting your debt under control is the first step to stop your financial house from leaking. Debt can reduce your wealth overtime.

Day 21: Diversify Your Savings

Understand different places and vehicles to help you keep and grow your money.

Day 22: Use Only Cash

Do you tend to spend less when using cash over credit cards?

Day 23: Understand How Inflation Works

Inflation can be the silent killer to your money. It can reduce your money’s purchasing power.

Day 24: Explore Investment Strategies

List and learn about different type of investment strategies we have today and see which one is suitable for you.

Day 25: Estate Planning

Do you have a will? Do you have power of attorney or health directive? Do you have a trust?

Day 26: Read 3 Financial Blogs

Reading assignments

Day 27: Stay On The Road To Wealth

Review your goals and what you have learned. Share this 30 Day Challenge with someone you care about and spread the love! Educate your community with the importance of financial literacy.

Day 28: Invest In Your Why

Do you know your “whys”? Have you taken steps to help you achieve your goals?

Day 29: Work With a Financial Professional

Consider working with a financial professional to build a custom wealth plan for your long term goals.

Day 30: Congratulations!

You have completed your 30 Day Challenge toward your financial goals. Keep it up!